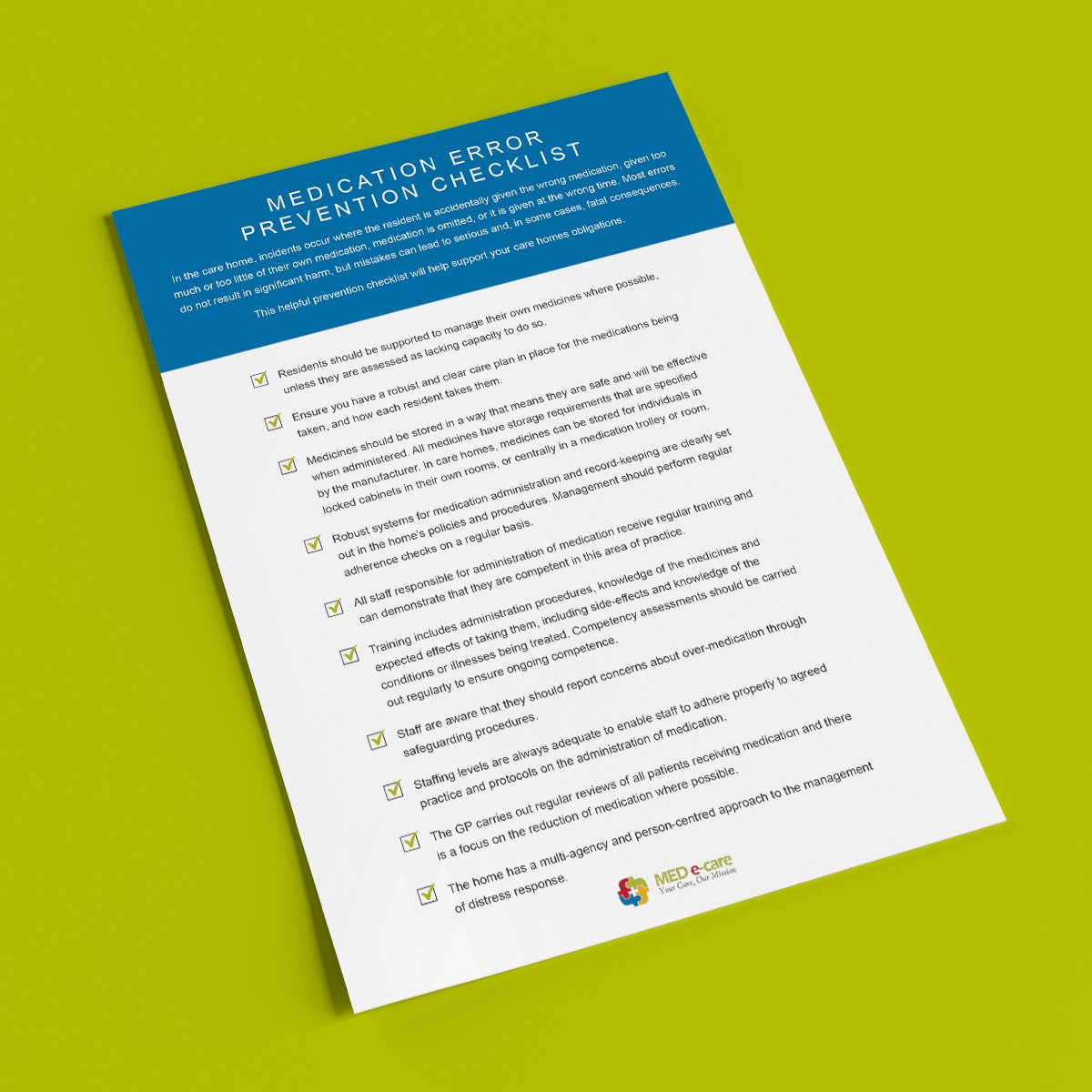

The Home Care Billing & Medicaid Playbook

Are You Actually Getting Paid What You Deserve?

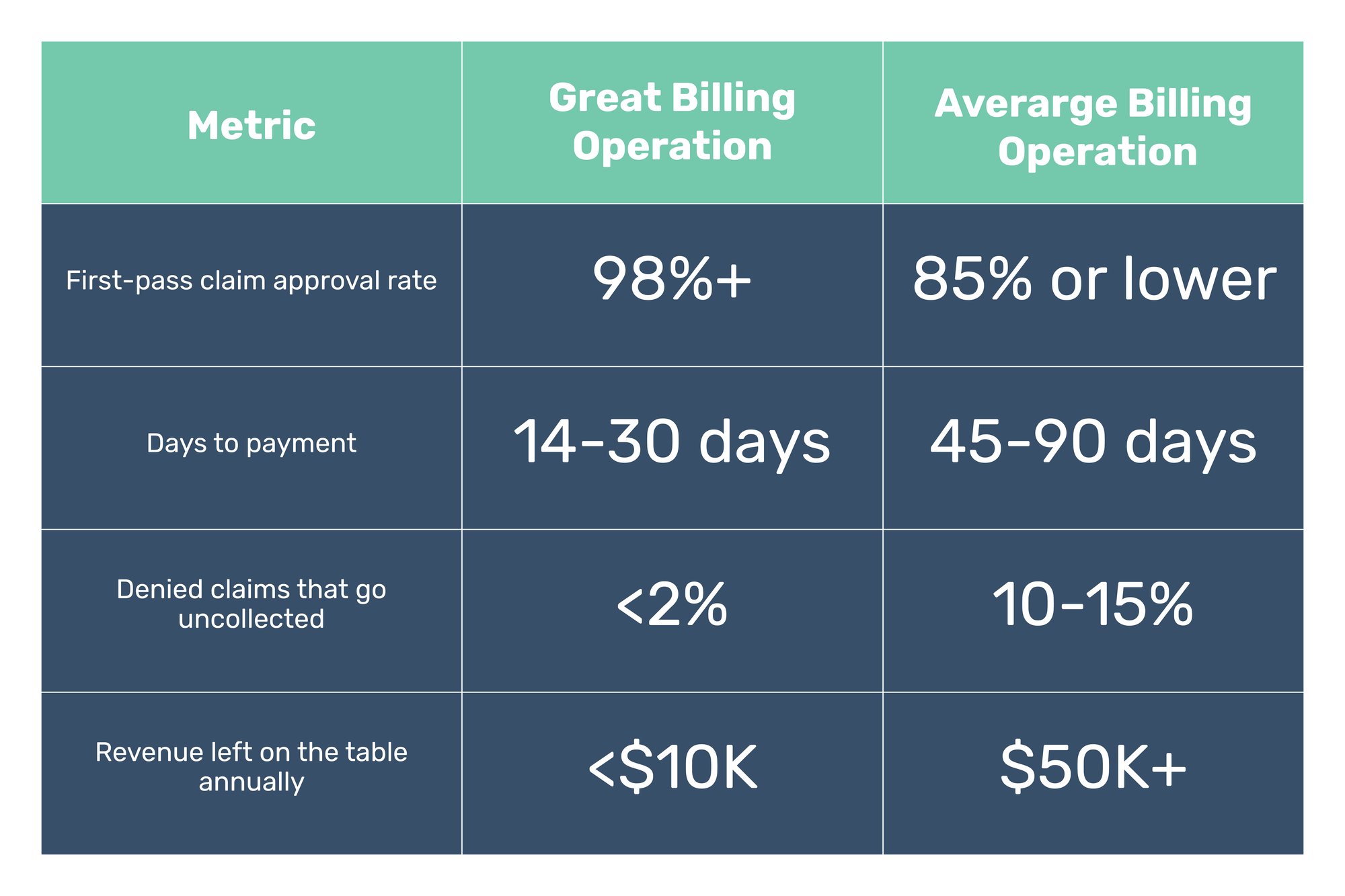

Billing is more than just submitting claims—it’s about making sure you actually get paid on time, in full, without costly delays or denials. Many home care agencies don’t realize how much revenue they’re missing out on due to inefficient billing processes. The difference between an average billing operation and a high-performing one can mean hundreds of thousands of dollars in lost revenue each year.

This playbook will help you:

Why Billing Matters

When done right, accurate billing means

Timely payroll for caregivers and staff

Financial stability for your agency

Compliance and fewer claim denials

The Revenue Cycle: What Really Getting Paid Looks Like

A strong billing process ensures that claims are submitted accurately and on time, payments are collected promptly, and cash flow remains steady. Here’s what that looks like: If your agency isn’t hitting these benchmarks, you’re likely leaving money on the table.

Understanding the Full Revenue Cycle

The revenue cycle is the process of collecting payment for services that your caregivers provide. Each stage of the revenue cycle depends on accurate data entry and compliance to ensure successful claims processing.

Confirm that clients’ eligibility status and benefits are current. For VA and Long-Term Care Insurance clients, ensure your team understands their policies and documentation requirements.

Data Entry

"It’s not done until it’s documented." Enter all key data, including authorization numbers, birthdays, and authorized hours, into your system.

Ensure caregivers clock in and out using EVV systems and document completed tasks for accurate claim submissions.

Use correct billing codes and fee schedules, and submit claims based on the payer’s billing cycle.

Address denials immediately to prevent revenue loss.

Regularly review contracts for compliance and maximize reimbursements.

Follow up on late payments and ensure all claims, not just current ones, are collected.

What Happens When Your Biller Goes Missing?

Many agencies don’t realize how dependent they are on a single in-house biller—until that biller quits, takes an unexpected leave, or simply stops showing up. When this happens, the consequences can be devastating:

Unsubmitted claims start piling up

Delayed payroll for caregivers and staff

Lost revenue due to missed filing deadlines

Increased claim denials due to rushed or incomplete submissions

How a Dedicated Billing Service Prevents This Crisis

A great third-party billing provider ensures continuity, so your agency never experiences a revenue gap due to staff turnover.

They provide:

![]() A team of experts, so billing doesn’t rely on just one person

A team of experts, so billing doesn’t rely on just one person ![]() 24/7 claim tracking, so nothing falls through the cracks

24/7 claim tracking, so nothing falls through the cracks ![]() Ongoing claim follow-ups, even if a team member leaves

Ongoing claim follow-ups, even if a team member leaves ![]() Seamless transitions, so your revenue doesn’t suffer from staffing changes

Seamless transitions, so your revenue doesn’t suffer from staffing changes

How Third-Party Billing and RCM Work Together

Many agencies use third-party billing services to submit claims, but Revenue Cycle Management (RCM) goes deeper.

- Third-Party Billing handles claims submission and processing. Once your agency provides care and documents services, a billing service submits claims on your behalf.

- RCM Management is the full financial strategy behind billing. It includes tracking claims, fixing denials, managing accounts receivable, and improving cash flow to make sure your agency gets paid what it’s owed.

Why It Matters

Relying only on third-party billing without strong RCM practices can lead to unpaid claims and lost revenue. Even with an outsourced billing provider, agencies should:

![]() Track outstanding claims and follow up on denials

Track outstanding claims and follow up on denials![]() Monitor cash flow and ensure payments are received on time

Monitor cash flow and ensure payments are received on time![]() Train internal teams to gather accurate client data and documentation

Train internal teams to gather accurate client data and documentation

Think of it this way: Billing is a transaction. RCM is a strategy.

Now let's bust some Myths! The Truth About Aggregators

Let’s break down some of the most common myths that agencies hear about aggregators:

Myth #1

“I Have to Use the Aggregator’s System Exclusively”

Truth: While a specific aggregator may be mandated in your state, you are NOT required to use their software as your primary EVV or billing solution. Agencies can use software solutions like CareTime or others to streamline their workflows while still complying with state mandates.

Myth #2

“The Aggregator Ensures My Agency is Always Compliant”

Truth: Aggregators only collect data—they do not actively monitor compliance or ensure error-free claims. If an agency’s submissions have missing information or incorrect coding, it’s up to the agency to identify and correct these errors. This can lead to payment delays and claim denials.

Myth #3

“The Aggregator’s Customer Support Will Help Resolve My Issues”

Truth: Many agencies report frustration with aggregator support systems. Instead of direct, real-time assistance, agencies are often forced to submit tickets and wait for responses—sometimes for days. This can create bottlenecks in billing and compliance.

The Limitations of Aggregators (And Why Agencies Need More)

While aggregators play a necessary role in EVV data collection, they lack critical features that agencies need to operate smoothly. Some key limitations include:

- No Real-Time Compliance Adjustments: If regulations change, aggregators do not automatically update their validation rules. Agencies must manually adjust their processes or risk falling out of compliance.

- No Built-In Workflow Automation: Aggregators do not assist with scheduling, billing, or visit validation—agencies must handle these tasks separately, increasing administrative burden.

- No Error Prevention or Resubmission Assistance: Errors are only detected after submission, meaning agencies have to go back, fix issues, and resubmit claims, delaying payments.

Why Agencies Benefit from Additional Software Solutions

Using a robust home care software solution alongside an aggregator eliminates many of these inefficiencies and ensures seamless EVV compliance, billing, and revenue management.

Key Benefits of Using Software Solutions Like CareTime

Automated Compliance Monitoring

Real-Time Error Detection

Smooth EVV Data Transfer

24/7 Customer Support

Built-In Automation for Billing & Scheduling

The Bottom Line

Cash Flow Tips for Long-Term Success

Automate Where Possible

Use billing software to streamline claims submission and tracking.

Train Your Team

Ensure staff understand billing best practices to prevent costly mistakes.

Monitor Claims Daily

Track submissions, approvals, and denials to stay ahead.

Work With Experts

A dedicated billing and RCM partner can help maximize revenue and prevent costly errors.